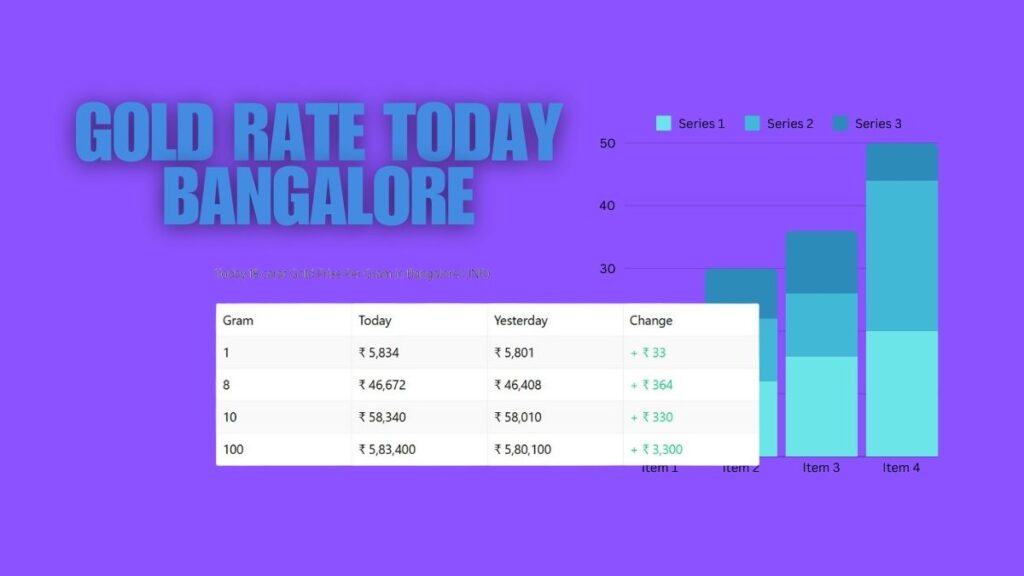

Today 18 carat Gold Prise Per Gram in Bangalore ( INR)

| Gram | Today | Yesterday | Change |

| 1 | ₹ 5,835 | ₹ 5,834 | + ₹ 1 |

| 8 | ₹ 46,680 | ₹ 46,672 | + ₹ 8 |

| 10 | ₹ 58,350 | ₹ 58,340 | + ₹ 10 |

| 100 | ₹ 5,83,500 | ₹ 5,83,400 | + ₹ 100 |

Today 22 carat Gold Prise Per Gram in Bangalore ( INR)

| Gram | Today | Yesterday | Change |

| 1 | ₹ 7,131 | ₹ 7,130 | + ₹ 1 |

| 8 | ₹ 57,048 | ₹ 57,040 | + ₹ 8 |

| 10 | ₹ 71,310 | ₹ 71,300 | + ₹ 10 |

| 100 | ₹ 7,13,100 | ₹ 7,13,000 | + ₹ 100 |

Today 24 carat Gold Prise Per Gram in Bangalore ( INR)

| Gram | Today | Yesterday | Change |

| 1 | ₹ 7,779 | ₹ 7,778 | + ₹1 |

| 8 | ₹ 62,232 | ₹ 62,224 | + ₹ 8 |

| 10 | ₹ 77,790 | ₹ 77,780 | + ₹ 10 |

| 100 | ₹ 7,77,900 | ₹ 7,77,800 | + ₹ 100 |

Gold Price Trend in Bangalore

Bangalore has been witnessing an uptrend in Gold prices over the last one year. It is likely that we may see some drop in the prices of gold in Bangalore, given the shap movement. Those looking to buy gold in Bangalore could wait for sometime. It is likely that we may see a drop, before any rally, at which time it would be a good proposition to buy gold all over again. Wait for dips before buying the precious metal.

How is the 916 Gold Rate Determined in Bangalore?

Understanding how the 916 gold rate (also known as 22-karat gold) is determined in Bangalore involves delving into several influencing factors. While it may seem complex, these rates are influenced by a mix of global and local dynamics. Let’s break it down:

1. Global Trends

- International Market Movements: The price of gold in the international market sets the foundation for local prices.

- Interest Rate Fluctuations: Gold prices are inversely related to interest rates. When interest rates rise, gold prices tend to drop, and vice versa.

- Currency Exchange Rates: The strength of the US dollar against other currencies, including the Indian Rupee, significantly impacts gold prices. A stronger dollar can lead to higher gold costs in India due to currency conversion dynamics.

2. Local Factors in India

- Import Duty Rates: India imports a majority of its gold, so import duties play a crucial role. If the government increases these tariffs, gold prices rise. Conversely, a reduction in import duties leads to a fall in gold rates.

- Local Demand and Supply: During festive seasons and wedding periods, demand for gold spikes, pushing prices higher.

3. Other Influences

While the above factors are the most significant, there are numerous other variables, including inflation, geopolitical events, and changes in domestic policies, that impact gold rates.

When to Buy or Sell Gold in Bangalore?

For investors, timing is key. A general rule of thumb is to buy gold when prices dip and sell when they rise. However, this strategy requires continuous monitoring of market trends and local gold rates. Since gold prices are subject to frequent fluctuations, staying updated on these changes is essential before making a purchase.

In conclusion, the determination of 916 gold rates in Bangalore is a multifaceted process driven by a combination of international and local factors. While it’s challenging to predict precise movements, being aware of these dynamics can help buyers and investors make informed decisions.

Where to Buy Gold in Bangalore?

Bangalore offers numerous options for purchasing gold, catering to a variety of needs and preferences. The city has seen a significant rise in gold prices over the past year, thanks to global market trends, making it a bustling hub for gold buyers.

1. Popular Gold Shopping Destinations

- MG Road: This bustling area is home to several renowned jewelry stores offering a wide range of designs and purity levels.

- Jayanagar: Visit shops like Bhima Jewellers and R R Gold Palace, which are well-known for their exquisite collections.

- Dickenson Road: Jos Alukkas, located here, is another trusted name for gold jewelry buyers.

- Tanishq Stores: Spread across Bangalore, Tanishq offers hallmarked gold and a reputation for quality and trust.

2. Online Gold Shopping

In addition to physical stores, purchasing gold jewelry online has become increasingly popular. It can sometimes be more cost-effective than visiting traditional stores due to lower operational costs. However, it’s crucial to ensure the following:

- Buy only from reputed jewelers or platforms.

- Verify the gold’s purity, ideally ensuring it is hallmarked.

- Check for transparent return policies and certifications provided by the seller.

3. Important Considerations

- Purity: Always ensure that the gold you buy is hallmarked, which certifies its authenticity and purity.

- Pricing Transparency: Compare making charges and gold rates across stores and online platforms to get the best deal.

- Trustworthy Sellers: Stick to reputable jewelers with a long-standing reputation for reliability.

Whether you prefer the experience of shopping in a physical store or the convenience of online purchasing, Bangalore provides a variety of choices for buying gold. Ensuring quality, authenticity, and value should always be your top priorities.

Best Places to Buy Gold in Bangalore

Bangalore offers a variety of options for purchasing gold, making it a favorable city for both investors and buyers of gold jewelry. Unlike Mumbai’s concentrated gold market at Charni Road, gold shops in Bangalore are more spread out, providing options across different parts of the city.

Popular Gold Shopping Locations

- Dickenson Road: A well-known hub with numerous trusted jewelry stores.

- Jayanagar and Chickpet: These areas are home to many reputed jewelers offering a wide range of designs and gold types.

- Other Neighborhoods: Gold shops are present in almost every major area of Bangalore, ensuring accessibility no matter where you are located.

Finding the Best Deals

The best place to buy gold isn’t determined by the shop itself but by where you can secure the most favorable rates. While gold prices remain consistent across the city, making charges often vary significantly between jewelers.

- Regular Customers: If you are a frequent buyer at a particular jeweler, you may have better chances of receiving discounts on making charges.

- Negotiation is Key: Always negotiate the making charges to secure a better deal. Many jewelers are open to reducing these charges, especially for regular or bulk buyers.

Things to Keep in Mind

- Purity and Hallmarking: Always ensure that the gold is hallmarked to guarantee its authenticity and purity.

- Price Transparency: Compare rates across different shops and confirm the making charges before finalizing your purchase.

- Trustworthy Jewelers: Stick to reputable and established shops to avoid any risks of being duped.

In summary, the best place to buy gold in Bangalore is where you can get the best combination of quality, authenticity, and favorable making charges. Whether you’re shopping for investment or adornment, taking time to compare rates and negotiate can make all the difference.

What Should You Know Before Buying Gold Jewelry for the First Time in Bangalore?

Buying gold jewelry for the first time is an exciting yet significant financial decision. It’s essential to be well-informed to make the best choice and get value for your money. Here’s a comprehensive guide to help you:

1. Understand Gold Purity

- In Bangalore, the most commonly sold jewelry is made of 22-karat gold.

- Check the gold rate on the day of purchase, as prices fluctuate daily. Use a reliable website like goodreturns.in to get accurate gold rate updates.

2. Look for the BIS Hallmark

- Ensure that the jewelry carries a BIS hallmark, which certifies the purity of the gold.

- The hallmark, issued by the Bureau of Indian Standards (BIS), guarantees that the gold meets the specified karatage (e.g., 22 karats).

3. Know About Making and Wastage Charges

- Jewelers apply making charges (labor costs) and wastage charges (metal lost during crafting) to the price of gold.

- These charges vary by jeweler and design, so always ask for a breakdown of costs and check the final bill carefully.

4. Verify the Bill

- Before completing the transaction, ensure that the bill includes:

- Weight of the gold.

- Gold rate per gram.

- Making and wastage charges.

- Hallmark certification details.

5. Choose Unique and Timeless Designs

- Since gold jewelry is a significant investment, opt for designs that are unique and timeless. This ensures that the piece remains relevant and valuable over time.

Bonus Tips

- Compare Prices: Visit multiple jewelers to compare making charges and design options.

- Negotiate: Don’t hesitate to negotiate making charges, especially if you’re purchasing in bulk.

- Buy from Reputable Jewelers: Stick to well-established shops to ensure authenticity and a seamless shopping experience.

Quality Inspection Before Buying Gold in Bangalore

Before buying gold in Bangalore, you should focus on the quality. While a few decades ago, you could easily be swindled before buying gold, today that is no longer the case. You can today check for quality before purchasing gold. In fact, most of the gold today is hallmarked.

One good advantage of buying gold in Bangalore, is that you have well established shops here. So, you do not have to worry too much about quality. Nevertheless, you can do your own inspection before buying gold. If you know the mechanism to check gold for purity, you can do it yourself. There is something called an acid test, which you can conduct.

What is Making Charges on Gold Jewellery?

Apart from checking gold rates in Bangalore, you need to look at making charges as well. Making charge is a charge which is added to the price of the jewelry before arriving at the final sale price. The making charges for an ornament may vary depending upon the type of jewelry a customer is purchasing.

It also depends on the fine detailing required while manufacturing the jewelry.The making charges differ from one jeweler to another one in Bangalore. Some jewelers in Bangalore call it as making charges and others will call it as wastage charges. If the finishing of jewelry is man-made, then the making charges will be more as compared to the finishing of jewelry made using a machine.

The rates of the product also differ from one shop to another shop as well as from one city to another city. For example: In Bengaluru, Tanishq is currently charging making charges starting at 8% on the jewelry pieces.

Whereas, Kalyan Jewellers do not charge any making charges under the Kalyan Priority scheme. The scheme provides members with an opportunity to get more benefits throughout the year which includes zero percent making charges or no wastage charges for gold, uncut, precious, polki and diamond jewelry.

How to Check for Purity of Gold in Bangalore

When purchasing gold in Bangalore, ensuring its purity and quality is crucial. Here’s a step-by-step guide to help you verify the authenticity of the gold you buy:

1. Compare Gold Rates in Bangalore

- Start by comparing the gold rates across reliable sources to understand the prevailing market price. This helps ensure you’re paying a fair price.

2. Look for BIS Hallmark

- The most reliable way to check for purity is to look for the BIS (Bureau of Indian Standards) hallmark. This triangular stamp is an assurance of the gold’s purity and quality.

- Check the Year Stamp: Alongside the hallmark, you’ll find a year code stamped on the gold, which corresponds to the year of certification. This isn’t a standard year format but a specific code set by BIS.

3. Avoid Non-Hallmarked Gold

- Buying non-hallmarked gold can increase the risk of being duped with substandard purity levels. Always insist on hallmarked gold to safeguard your investment.

4. Buying Gold Coins

- If you’re planning to invest in gold coins, consider purchasing them from reputable banks. Many banks offer well-sealed, Swiss-made gold coins that come with a high level of purity and reliability.

Key Tips for Buyers

- Always verify the BIS hallmark before making any purchase.

- Compare prices and ensure transparency in the billing process.

- Choose reputable jewelers or banks for peace of mind and quality assurance.

Purchasing Hallmarked Gold in Bangalore

It is important to purchase only hallmarked gold, when you are buying gold in Bangalore. This is because the chances of you getting duped when buying gold is almost zero. The Bureau of Indian Standards or more popularly BIS is assigned with the task of hallmarking gold in India.

So, before you buy hallmarked gold in Bangalore, look for a number of things including the logo of the BIS. Apart from the logo of BIS you would have the name or the logo of the jeweler. You would also have the date of manufacture of the gold. The other important thing to remember is that you should also take the receipt of the gold that you purchase.

This would help in the future if you want to sell the gold jewelery. Actually, it makes very little sense to sell jewelery because you lose on making charges. Hallmarked gold of 916 purity is the most popular set of gold that you would normally buy. Hallmarked gold is nothing but gold of 22 karats purity. You can also buy gold of 22 and 24 karats, which is normally available in gold bars and gold bisuits.

Buying Gold in Bangalore? Try Small Quantities

If you are looking to buy gold in Bangalore, we suggest that you look to invest in small quantities. This is because, it would help to average the cost of gold. Let us give you an example. Say, you want to buy gold worth Rs 2 lakhs. It makes sense to buy in small quantities, as if the price falls, you can buy at lower rates. Of course, you tend to lose if gold prices go higher.

The ideal way would be to buy say 10 grams of gold each time. Also, if you are looking to invest, try the Gold ETFs as they are more liquid and can be sold very easily. Talk to your stock broker, who could guide you on ways to buy the gold etd. In fact, the procedure is the same like buying equity shares. What we recommend is that the prices of gold at the moment are rather high. So, use a strategy of buying gold on dips.

What Type of Gold to Buy in Bangalore?

There are various types of gold, including physical gold, ETFs and gold bonds that you can invest in. We strongly suggest that you buy gold ETFs, which are traded on the stock exchanges in India, if you really want to buy gold. Why do you really need to buy and worry about storage and other things? There are a number of reasons apart from storage worries that you need to buy Gold ETFs.

There is no need to worry about your gold being stolen, as gold ETFs are held in demat form. In fact gold ETFs today are the most popular form of gold investments. The other things is that this gold instrument is also very liquid. So, if you want to sell, you are unlikely to have a big problem.

There is one rate and you do not have to go searching to find the best goldsmith, that would give you the best gold rates. The other advantage is that you can sell the gold anytime and at any place, which is another big plus for you. So, do buy Gold ETFs in Bangalore.

Digital Gold: A Modern Way to Invest in Bangalore

Gold has traditionally been purchased in three primary forms: physical gold, gold bonds, and now, increasingly, in digital form. In Bangalore, the concept of digital gold is gaining popularity as a convenient and flexible investment option. Let’s break down the differences and benefits of each form:

1. Physical Gold

- What It Is: Physical gold refers to the jewelry, coins, or bars you can buy from a jeweler or retailer.

- Usage: Most buyers of physical gold do so for personal use, such as wearing jewelry, rather than as an investment.

- Drawbacks for Investors:

- Includes additional charges like making charges and wastage fees, which are not recoverable.

- Security and storage can be a concern.

2. Gold Bonds

- What They Are: Gold bonds are issued by financial institutions or governments, allowing investors to gain exposure to gold without owning it physically.

- Advantages:

- No storage concerns.

- Free from additional charges like those associated with physical gold.

- Offers interest on the investment, making it a dual-benefit option.

3. Digital Gold

- What It Is: Digital gold refers to gold purchased in electronic form, where you own gold virtually but don’t physically possess it.

- How to Invest:

- ETFs (Exchange-Traded Funds): Traded on stock exchanges, ETFs are a common way to invest in digital gold.

- MCX (Multi Commodity Exchange): You can trade gold during market hours.

- Paytm and Other Platforms: Recently, platforms like Paytm have launched services that allow users to buy, sell, and store gold digitally within their wallets.

Advantages of Digital Gold

- Flexibility: On platforms like Paytm, you can buy or sell gold anytime, unlike ETFs or MCX, which are restricted to trading hours.

- No Storage Hassles: Digital gold eliminates the need for physical storage and associated risks.

- Small Investments: It allows you to invest in fractional amounts, making it accessible to all types of investors.

Choosing the Right Form of Gold Investment

- If you’re looking for convenience and low overheads, digital gold or gold bonds are excellent options.

- For personal use or cultural significance, physical gold might be more appealing.

By understanding the nuances of each option, you can make an informed decision that aligns with your financial goals. Digital gold, in particular, is a promising new avenue for investors in Bangalore, offering both convenience and flexibility.

Buying Gold ETFs in Bangalore

Among the many ways to buy gold in Bangalore is also through the ETF route. ETFs are popularly known as gold ETFs. They track gold prices and when gold prices go higher or lower, they tend to move in tandem with them.

Most of the top mutual funds in India have come up with a Gold ETF. The biggest is the Goldman Sachs Gold BES Etf, while other big ones are SBI Gold ETF, Axis Gold ETF, HDFC Gold ETF etc. Most of these gold ETFs tend to give similar returns to investors as they track the prices of gold.

in fact, buying gold ETFs maybe slightly cheaper then buying gold in the physical form, where there is also a huge difference between the buying and selling margin. So, if you are looking at the many options of buying gold, one of the best would be gold ETFs. This is an excellent bet for those who are planning their long term investments in India. However, you may need some expertise and advise before buying into this metal.

A Positive Trend for Gold Prices

Gold prices are showing a healthy upward trend, reflecting a renewed sense of optimism among investors. While the performance in 2017 was fairly stable, the three years preceding it witnessed little to no gains, marking a challenging phase for the precious metal. Over the last five years, gold prices have experienced a flat to negative trajectory.

However, when analyzing the past decade, gold has delivered notable returns, primarily due to the subprime mortgage crisis in the United States, which fueled a surge in demand for safe-haven assets like gold.

Is the Recovery Sustainable?

The current rise in gold prices is encouraging, but its sustainability remains uncertain. If this is merely a temporary fluctuation, we could see a return to low-performing levels. On the other hand, a consistent upward trajectory could mark a strong revival for gold as a long-term investment.

Factors Affecting Demand

In recent years, demand for gold has declined significantly. Countries like India have implemented measures to discourage gold consumption, contributing to periodic dips in its price. These policies aim to curb excessive gold imports and balance trade deficits.

Why Gold Still Matters

Despite the challenges, gold remains an essential part of a diversified investment portfolio. Its historical role as a reliable asset during economic uncertainty makes it a safe haven for investors. During times of financial instability, gold often acts as a refuge, preserving wealth when other assets falter.

For those looking to diversify their assets, investing in gold can still be a prudent choice. The precious metal’s enduring value and stability during turbulent times make it a worthwhile consideration in any investment strategy.

Why Do People in Bangalore Buy and Sell Gold Coins?

In Bangalore, gold coins are a popular choice for buying and selling due to their versatility and value. People opt for gold coins for various reasons, depending on their individual goals and requirements. Here’s a look at the most common motivations:

1. Gold Coins as an Investment

- Why Coins Over Jewelry:

Investors prefer gold coins over jewelry because coins do not involve additional costs like making and wastage charges. These charges, incurred while purchasing jewelry, are not recovered when selling, making coins a more cost-effective option. - Investment Strategy:

Like stocks, investors buy gold coins when prices are low and sell when prices rise, leveraging market trends to maximize profits.

2. Gold as a Safety Measure

- Hedge Against Currency Risks:

Moves like demonetization have shown that paper currency can lose its value unexpectedly. Gold coins, in contrast, provide a reliable store of value. - Future Security:

In case of similar economic events, holding gold coins can offer financial stability and peace of mind.

3. Gold as Insurance

- Protection Against Inflation:

Gold acts as a hedge against inflation and currency devaluation, particularly during periods of economic instability or geopolitical tensions. - Crisis Hedge:

Whether it’s a fall in the Indian rupee’s value against the US dollar or rising global uncertainties, gold remains a stable and valuable asset to protect wealth.

Tips for Buying Gold Coins

- Avoid Overbuying: While gold is a secure asset, purchasing excessively at any price can lead to financial strain.

- Be Strategic: Monitor gold prices, invest thoughtfully, and balance gold purchases with other assets in your portfolio.

Gold coins are an excellent option for those seeking a flexible and secure way to invest, save, or hedge against economic uncertainties. With proper planning and careful purchasing, gold can be a valuable addition to anyone’s financial strategy.

The Problems of Investing in Gold in Bangalore

Gold does not tend to yield the best returns in the short term and there are plenty of reasons for the same. Let us given an example. Say, you go ahead and invest systematically in gold coins. Now, the problem is that everytime you buy a gold coin, you end-up paying taxes on the same, which can vary from 10-15 per cent.

What this means is that you have to now recover the cost of that taxes to make some money on gold. What this means is that even if you take a decent returns of 8 per cent, gold prices must rally as much as 22 per cent for you take make -up those losses.

That may never happen in one year and hence your holding time frame has to be large for you to really make some money on gold. The longer you hold the more returns you can make on the same.

What Causes Bangalore Gold Demand to Fall?

It has not been a very good year for gold demand, though prices in the city have kept pace. Demand this year has fallen across categories, which includes gold jewellery and gold which is used for industry.

According to statistics from the World Gold Council, there has been a lower demand across various categories. This may also have led to lower demand for the precious metal in the city of Bangalore. Will there be a good rally in prices and demand in Bengaluru for the precious metal is always difficult to predict. For example, much would depend on the prices of gold in Bengaluru. When prices fall, individuals tend to buy more of the precious metal. On the other hand when gold rallies investors tend to stay away and this could lead to a fall in demand. This maybe one reason why we are seeing lesser demand for gold in Bangalore in the last few months.

Different Karat Options for Buying Gold in Bangalore

When buying gold in Bangalore, consumers and investors have several karat options to choose from, each representing a different level of purity. Understanding the concept of karat is essential for making informed decisions.

What Does Karat Mean?

The term “karat” refers to the purity of gold. It indicates the proportion of pure gold mixed with other metals to create the final alloy. The higher the karat, the purer the gold.

1. 24 Karat Gold

- Purity: 99.9% pure gold.

- Usage: Ideal for investment purposes, such as gold coins or bars, but unsuitable for making jewelry due to its softness.

2. 22 Karat Gold

- Purity: 91.6% pure gold (22 parts gold and 2 parts alloy).

- Usage: The most popular option for making jewelry in India, including Bangalore. The addition of alloy enhances its durability while retaining a high level of purity.

- Also Known As: 916 gold, referencing its 91.6% purity.

3. 18 Karat Gold

- Purity: 75% pure gold (18 parts gold and 6 parts alloy).

- Usage: Commonly used for designer jewelry and pieces with intricate craftsmanship. The lower purity level makes it more affordable than 22 karat gold.

4. Other Karat Options

- 14 Karat Gold: Contains 58.3% pure gold. Rarely used in Bangalore but can be found in some designer or lightweight jewelry.

- 8 Karat Gold: Contains only 33.3% pure gold. This is uncommon in India but more prevalent in Western countries.

Global Perspective

In Western countries, lower-purity gold such as 14 karat and 8 karat are more popular due to their affordability and durability. In India, however, higher-purity options like 22 karat and 18 karat are preferred for their cultural significance and value.

Choosing the Right Karat

The choice of karat depends on the purpose of the purchase:

- For investment, opt for 24 karat gold.

- For jewelry, 22 karat gold is ideal for durability and tradition, while 18 karat gold suits modern and intricate designs.

Understanding the karat system allows buyers to select the most suitable option based on their needs, ensuring they get the best value for their money.

22 Karats vs 24 karts vs 18 Karats

Choosing between 22 karats, 24 karats and 18 karats gold is not always easy in Bangalore. If you are looking to buy gold jewellery, the ideal way would be through 22 karats gold. You cannot make gold jewellery through 24 karats gold, because it will break. While 18 karats is also in vogue, as the purity is lower, you get lesser price for the same when you sell the same.

The demand is always high for 22 karats gold jewellery and it is also easier to sell the same. So, when you buy the same keep in mind the ability to sell the same. If you have lesser amount and a smaller budget it is best to stay invested in 18 karats gold. However, as we mentioned earlier there is not too much demand for the metal and you may end-up selling the same at substantially lower rates. If you are buying 24 karats, the best option would be to buy gold coins and bars.

22 Karats or 24 Karats: Which to Buy in Bangalore?

You have a choice of 22 karats or 24 karats gold that you can buy when it comes to gold. One this is clear and that is if you are buying gold jewellery it needs to be in 22 karats gold. On the other hand, if you are buying 24 karats gold, go for the easily saleable gold coins and biscuits.

We say this because gold coins and biscuits are easy to sell, as compared to ornaments, which there is a loss on melting. Apart from this the money spent on making of gold jewellery is also wasted. So overall, there is a terrific wastage of the product. One fails to understand why investors choose to invest in jewellery in the city of Bangalore. If you want to, go straight away for biscuits where you would not waste too much money on wastage and making charges. If you cannot afford biscuits, you also look for gold coins, where you get slightly smaller quantities.

How to Convert Karats to Purity?

Understanding the purity of gold based on its karat value is straightforward with a simple calculation. Here’s how you can determine the gold content in any karat:

The Formula

To calculate the purity percentage of gold:

(Karat Value ÷ 24) × 100 = Purity Percentage

Example: 18 Karat Gold

Let’s calculate the purity of 18 karat gold:

- Take the karat value, which is 18.

- Divide it by 24 (the maximum karat value for pure gold).

- Multiply the result by 100.

(18 ÷ 24) × 100 = 75%

So, 18 karat gold is 75% pure, meaning it contains 75% gold and 25% alloy.

Other Examples

- 14 Karat Gold:

(14 ÷ 24) × 100 = 58.3%

This means 14 karat gold is 58.3% pure. - 10 Karat Gold:

(10 ÷ 24) × 100 = 41.7%

This means 10 karat gold is 41.7% pure.

Gold Purity in India vs. Abroad

- In India, high-purity gold such as 22 karat (91.6%) and 18 karat (75%) is more commonly available.

- Lower-purity options like 14 karat (58.3%) and 10 karat (41.7%) are rare in India but are more popular abroad due to their affordability and durability.

What is the Meaning of 916 Hallmarked Gold?

Today’s gold rates in Bangalore largely depend on the type of purity. What individuals often look at is 916 hallmarked gold. This is normally nothing but gold of 22 karats purity. Individuals who are purchasing gold or buying the same for investing need to look at either 22 karats or 24 karats gold and that too with hallmarking.

The onus for hallmarking is with the Bureau Of Indian Standards, more popularly known as BIS. The concept of hallmarking gold jewellery began in 2000. Since then all Indian are assured of hallmarked jewelery in India. Thought it is not compulsory to buy hallmarked gold, there have been instances, where there has been some duplication. This has led to authorities regularly checking and implementing controls over the same. There are essaying centres where you can find this checking done.

Why Central Bank Policy Impacts Gold Rates in Bangalore?

The Central bank of a country provides financial and banking services for the nation and implement the government’s monetary policy and issuing currency. Central Banks’ monetary policy is the primary driver behind gold prices.

The central bank and its actions play an important role in setting the gold rates. As the banks and gold mining companies have the huge storage of gold as a reserve, they can manipulate the gold prices. Banks can affect the rate when they buy or sell gold in bulk, or the mine owners increase the production or reduce the output of gold.

Sometimes the central banks may buy more gold when they find a decrease in their gold reserves against their holding. When the central policy is announced, and the interest rate is hiked then investors will be receiving more interest by investing in US treasuries as they are also AAA rated and backed by US government.

Gold is considered as the safe heaven in difficult times. When interest rate hike, investors will move money out of gold and park in treasuries. Interest hike in policies will lead to less demand for gold. Then gold prices will be moving down. This will increases demand for US dollar.

Bangalore Gold Rates and the Impact of Central Bank Intervention

Gold prices in Bangalore are influenced by several factors, one of which is the buying activity of central banks around the world. For instance, the Reserve Bank of India (RBI) has significantly increased its gold reserves in the past. However, the global trend of central bank purchases has been less robust in recent years. In fact, reports indicate that central banks purchased only 271 tonnes of gold in the first 11 months of 2016, compared to 407 tonnes during the same period in 2015.

Historically, central banks have provided considerable support to gold prices through their buying activities, which boosts demand and helps drive up prices. The amount of gold these institutions purchase is largely decided by the central banks and their respective governments. This buying activity has a direct impact on gold prices—more purchases generally push prices higher, while selling gold could lead to a price drop.

However, the decision to boost or reduce reserves remains at the discretion of central banks. For gold buyers, it’s important to note that these decisions can change over time. Although changes in central bank policies can affect gold prices, the influence of central banks today is not as significant as it once was.

In recent years, gold exchange-traded funds (ETFs) have become some of the largest influencers of gold prices in India. These large-scale ETFs, through their buying and selling activities, have taken over the role of central banks in shaping gold prices. So, while central bank activity still plays a role, it is now the large-scale ETFs that have a greater impact on the price of gold in markets like Bangalore.

As a gold buyer, there’s no need to worry too much about central bank decisions, as these can shift over time. Instead, focus on tracking market trends influenced by factors like gold ETFs, which now have a more immediate impact on prices.

How do Gold Traders in Bangalore Assume Future Gold Prices?

There is no way one can tell how the gold rates in Banglore is going to change. The increase and decrease can be due to a lot of reasons. Still investors always keep on eye on few parameters to assume gold rates in Bangalore.

1. Following the news related to Gold

Every day there will be some or other news related to gold such as sometimes gold prices goes down due to strong US dollar and some times due to global cues. There will be some change in gold rates in Bangalore on this basis. One can follow this kind of news on goodreturns.in which will be giving perfect and accurate change in gold rates in Bangalore and the reasons behind the change.

2. Following prices of other precious metals such as silver.

There will be some relation between other precious metals rates due to which the gold rates in Bangalore also gets affected. So they follow silver rates in Banglaore as well everyday. Silver rates in Bangalore is also availble on goodreturns.in. Not only in Bangalore to assume future gold rates it is important to follow silver rates all around India.

3. Exchange rates of Rupee (INR) with other currencies

There will be up and down’s in rupee rates as well, which affects the gold rates in Bangalore because the exchange rates of rupee with other currencies show much affect on imports and exports we do.

Why Gold Prices Rise When the Stock Market Falls?

Gold often becomes the go-to investment for Bangalore investors during times of stock market downturns. When the stock market experiences a decline, many investors in Bangalore pull their money out of stocks and seek safer investment options. While some may turn to fixed deposits, a significant number of investors prefer commodities like silver and gold. This shift happens because, in times of uncertainty, investors look for stable, safe investment opportunities—and gold has consistently proven to be one of them.

This trend is not unique to Bangalore; it is observed globally. Gold is considered a “safe haven” asset, as its value tends to remain relatively stable, even when other markets experience volatility. Unlike stocks, where the value can fluctuate dramatically due to various external factors, the value of gold is less likely to fall below a certain threshold, making it a more secure choice.

For example, during the Brexit referendum, when the results triggered turmoil in the financial markets, investors rushed to pull their money out of stocks and invested heavily in gold. As a result, gold prices surged to a two-year high. Once the situation stabilized, investors shifted their money back into stocks, causing gold prices to correct.

In uncertain times, whether due to geopolitical events, market crashes, or economic crises, gold remains a popular choice for investors looking for security. This is why many Bangalore investors, who track stock market movements, also closely follow gold prices as a hedge against market instability.

Taxation of Gold in Bangalore

If you buy gold in Bangalore, you are subject to all the applicable taxes from time to time. Remember, the metal does not derive any income like dividends and hence the tax payable is more like capital gains tax.

So if you buy gold and then sell the metal you can make gains or profits, which are subject to taxes in the country. Now, you should also know that there could be a wealth tax that one needs to pay if you have own gold jewellery beyond a certain amount. How much you pay really depends on the amount of gold that you have. If you have amounts in excess of Rs 30 lakhs,

one per cent of the value of that has to be paid in taxes. Remember, that you have to declare the same or your gold can even be seized by the authorities. Not many people are aware of this and they have to be told about the same. It is important to remember that there is compliance that is needed when you buy and sell gold in Bangalore, especially the tax compliance.

Availing Gold Loans in Bangalore

Sometimes when you are in dire need taking a gold loan would not be a bad idea. There are various reasons why you should opt for a gold loan. If you are opting for any other loans, it could be either tedious or time consuming. Hence, a better proposition would always be a gold loan. All you have to do is carry your gold with you and just pledge the same.

You might need an identification. Gold loan companies do not have any stringent norms, because they know that you have pledged your gold. So, they have some kind of surety. What is important to note is that you should be in a position to pay back the money, because after all your gold is with the gold loan company. So, in case you are not able to pay the gold loan company has all the rights to confiscate the amount.

What this means is that you could lose your precious jewellery. It is hence very important to be sure that you can pay the same. Also, most of the gold jewellers in the country tend to keep your gold in their custody. One other thing that is worth mentioning about gold is that the tenure of the loan is very small at just 11 months. There are largely to major companies that give you gold loans. One of them is Muthoot Finance and the other is Mannapuram Finance.

There are also banks that offer you gold loans, though you need to study the gold loan rates that they offer. Do not blindly go into taking loans, if you have not compared the gold loans in India. Of course, one of the most important things when taking a gold loan is the interest rates offered and these days it is around the 12 per cent range.

Should You Take a Gold Loan in Bangalore?

There are many companies that provide you a gold loan. Among these include the banks and specialized gold loan companies like Muthoot Finance and Mannapuram Finance. If you are planning to take a gold loan, you should compare the same with personal loans.

Sometimes, personal loans offer you a better interest rates. However, for personal loans, you need to have a good credit rating. In the case of gold loans, you do not need a credit rating, and the loan is instant.

In fact, the gold loan company is not bothered about a default as they will sell the pledged gold that they have with them. So, in case you are planning to take a gold loan, make sure that you pay back the amount of loan taken or else you would have your family jewels sold.

Gold Schemes in Bangalore

In Bangalore, you can purchase gold through various gold schemes offered by well-known jewelers like Bhima and GRT. These schemes have evolved over time, especially following the decline in interest rates. Previously, many jewelers offered 10- or 11-month schemes, but today, the terms have become more flexible. While some schemes still provide discounts on making charges, don’t expect too many additional freebies.

Gold prices in Bangalore generally remain stable, and the price at the time of your investment in the scheme is usually locked in. This means if you enroll in a scheme when gold prices are, for example, Rs 28,000 per gram, your payment will be locked at that rate.

If gold prices fall, this could work against you, as you may end up paying more than the current market value. However, if gold prices rise, you stand to benefit, as the value of your investment will increase along with the price of gold.

Before committing to a gold scheme, it’s important to consider the potential risks and rewards based on market trends.

Gold in the Futures Market in Bangalore

If you’re considering buying gold in Bangalore today, one option to explore is the futures market. But what exactly is the gold futures market? It allows you to buy and sell gold at a future date, giving you the flexibility to trade without taking physical possession of the metal.

The key difference between the physical gold market and the futures market is that, in the physical market, you buy gold in its tangible form, while in the futures market, you agree to buy a specified quantity of gold at a predetermined price for future delivery. To participate in the futures market, you can open an account with a reputable stock broker who can facilitate trading on platforms like the Multi Commodity Exchange (MCX).

One of the advantages of the futures market is the ability to buy gold in small quantities by paying only a margin amount, rather than the full price. For example, if 10 grams of gold costs Rs 29,000 in the physical market, you don’t need to pay the entire Rs 29,000 upfront. Instead, you only need to pay a margin, which could be as low as 10% or even less. This means you could invest just Rs 2,900 to secure a position in gold futures.

While this can allow for larger exposure with less capital, it also comes with higher risk, as the leverage involved can magnify both potential gains and losses. As such, it’s important to approach gold futures trading with caution. Doing thorough research before entering the market is highly recommended.

Alternatively, gold exchange-traded funds (ETFs) offer a more transparent and lower-cost way to invest in gold, providing an option with reduced risks and simpler accessibility compared to the futures market.

How to Sell Physical Gold at the Highest Price in Bangalore?

It is not simple to sell physical gold. It is harder to get the highest prices for it as well. So to make things a little easy one can follow these instructions to get the best price for the gold one is trying to sell in Bangalore.

1) First, know what are the 22 karats or 24 karats live gold rates in Bangalore.

In order to set an idea how much money you should be getting for the gold you have.

2) The price of the gold you will be getting also depends on where you are selling your gold. Than going to a gold smith it is advisable to go to a well-known jeweler to get a good price for the gold you are selling.

3) Follow the stock market because As mentioned above gold is inversely proportional US Dollar not only dollar there are many more parameters that affect the gold rates in Bangalore it is better you wait and sell your gold when the time is right.

4) Study the history of gold, to estimate at which point of time you will be getting the best value of gold. One needs to study the history of gold and also needs to know due to what reasons gold rates in Bangalore changed at that time.

Better to be patient and sell the gold when such situations repeat. It is better if one goes for gold ETF’s than investing in physical gold. There will be fund managers or brokers who will be following up all the above measures and recommending you when to sell or buy.

Why Indians Love Gold?

India is rich in culture & tradition all over in the world. Indian women love ornaments. Gold is one among the precious ornaments, which individuals buy for various reasons. People buy gold for a variety of reasons such as for its auspicious sentiment, as an investment.

Gold continues to command long term value, a tag for being safe and to have a hedge against inflation, asset allocation, etc. Gold also carries a high perceived value and a high emotional quotient. It reinforces closeness of relationships.

Gold coins in smaller denominations are also considered apart for corporate gifting and rewards for contests. Almost every function(small or big) you see every woman wearing at least one ornament of gold. A famous saying “No gold No marriage.

” The mount of jewelry worn denotes the prosperity of the family. Gold is a symbol of wealth, and prosperity gold is an investment, safe and secure. It can be made use in times of need and emergency.The value of gold is high anytime, even during recessions. Despite all the possible reasons, gold rates in Bangalore should be checked before buying gold. Despite all the reasons for loving and buying the metal, you cannot buy gold and any price.

Importing Gold into Bangalore

Gold is generally imported by the large banks who then sell the same to dealers from where it is supplied to the retailers. For the purpose of making gold jewellery these are generally supplied in large gold bars. When international prices go higher, gold prices become costlier to import, which is when the price hike is reflected in the retail price of the precious metal, which is obviously passed on to the customer.

Trading in the futures market gives you a better indication of where gold prices in Bangalore are headed today. For example, in the futures market the trading opens much earlier, then the jewellery shops that open much later.

So, you get a clear indication of the days gold rates in Bangalore much ahead of time. This means that you can decide a little advance, as if the prices are high keeping in mind the futures trend, you can avoid purchasing gold for the day. We wish to emphasize that at all times it is necessary to keep an eye on the prices of gold.

This is because the precious metal is no longer a cheap commodity and variations in prices could mean a lot. If you feel that prices have now stabilized it would be a good time to make some buying decisions. However, if prices are volatile, you would do well to watch and wait on the sidelines. There is no point in importing gold these days and you are better off, using the local jewellery shop to buy into gold. The quality that we get in the Bangalore shops is excellent and there is no need to look beyond the same.

Problems with Essayed Gold in India

A recent study by the World Gold Council has found tht only 30 per cent of the gold jewelry in Indis is hallmarked. What this means is that there is still a very wide scope for impurities on jewelry, particularly with regards to areas where there are no Bureau of Indian Standards Essaying centre to hallmark gold jewelry.

Now, there is also a potential to increase the gold exports from India if the country is able to get hallmarking done very successfully. The problem right now is that there are not many essaying centres and hence you can still end-up having impurities in your gold and a 22 karat gold ornament may not be exactly the 22 karats purity that you wold like to have. The other problem that the government faces is that there is still lack of awareness among consumers to use only hallmarked jewelry.

Bangalore Yellow Metal Prices On 2nd December : Global Economic Factors Contribute To The Latest Decline

On December 2, 2024, gold prices in Bangalore experienced a notable decline across various purity levels. The 22-carat gold rate dropped by ₹600, bringing the price to ₹70,900 per 20 grams, while 24-carat gold saw a decrease of ₹650, retailing at ₹77,350. The more affordable 18-carat gold also fell, declining by ₹490 to ₹58,010. For bulk purchases,

100 grams of 24-carat gold is now priced at ₹7,73,500, a reduction of ₹6,500, and 100 grams of 22-carat gold slipped by ₹6,000, now costing ₹7,09,000. This decline comes as a surprise given the usual surge in gold demand during the wedding season in India. Traditionally, this period sees bullish trends due to high consumer interest; however, the current retail market is experiencing subdued demand. Despite numerous weddings scheduled, the expected seasonal uptick has not materialized.

Key international factors are contributing to this bearish trend. The strengthening of the U.S. dollar is placing downward pressure on gold prices globally. Additionally, market participants are closely watching for updates on U.S. economic data and the Federal Reserve’s interest rate decisions, which are anticipated to further influence investor sentiment and market dynamics.

Myntra: Exciting Opportunities for Fresher Software Engineers

Disclaimer: Goldratetodays makes no guarantee or warranty on the accuracy of the data provided on this site, the prevailing rates are susceptible to change with Market value and provided on an as-is basis. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. We accept no liability for any loss arising from the use of the data contained on this website.